Breaking News: Canal+ Offer for MultiChoice:

- Canal+, French TV business, offers 105 rand per share for MultiChoice minorities.

- Synergies between the two businesses.

- Legal considerations regarding foreign media ownership.

- MultiChoice closed at 75 rand; market likely to respond positively.

Market Updates:

- Hyprop reports positive festive trading for its tenants.

- Transaction Capital plans to list WeBuyCars in March; potential value unlock.

- Evergrande declared bankrupt with over 300 billion dollars in debt.

- Hong Kong economy expanded 3.2% in 2023.

- China overtakes Japan as the world's top car exporter.

Cristal Challenge Stock Picks:

Richemont*: Luxury brand with potential in a recovering economy.

[caption id="attachment_41062" align="aligncenter" width="849"] Richemont weekly chart close 31Jan24[/caption]

Richemont weekly chart close 31Jan24[/caption]

Calgro M3*: Debt under control, potential dividend, well-managed company.

[caption id="attachment_41063" align="aligncenter" width="849"] Calgro M3 weekly chart close 31Jan24[/caption]

Calgro M3 weekly chart close 31Jan24[/caption]

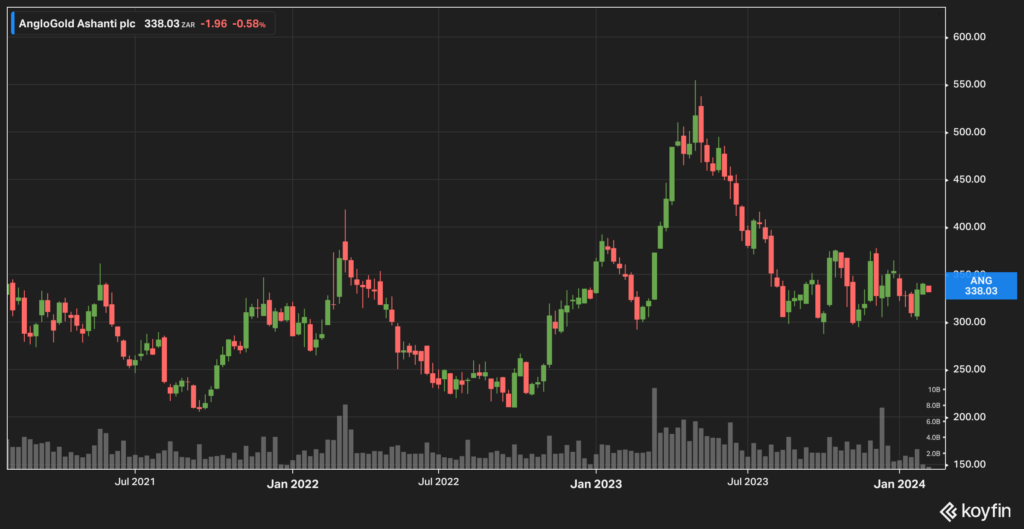

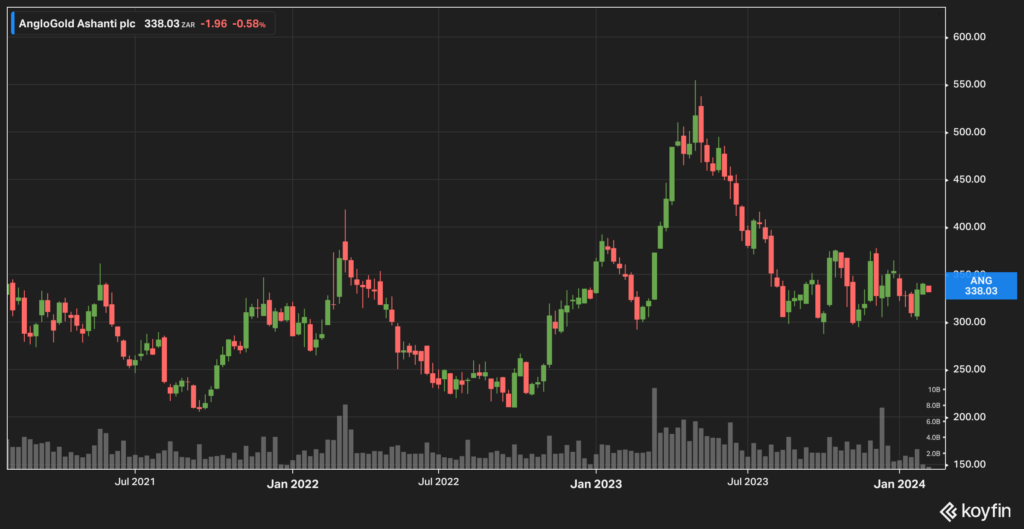

AngloGold Ashanti*: Gold as insurance; geopolitical concerns.

[caption id="attachment_41061" align="aligncenter" width="849"] Anglogold Ashanti weekly chart close 31Jan24[/caption]

Anglogold Ashanti weekly chart close 31Jan24[/caption]

Zeda: New listing, unbundling, potential growth.

[caption id="attachment_41065" align="aligncenter" width="849"] Zeda weekly chart close 31Jan24[/caption]

Zeda weekly chart close 31Jan24[/caption]

Mr. Price*: Positioned well in the retail sector, positive trading update.

[caption id="attachment_41064" align="aligncenter" width="849"] Mr Price weekly chart close 31Jan24[/caption]

Mr Price weekly chart close 31Jan24[/caption]

Closing Remarks:

Reminder to sign up for email alerts before live sessions.

Host: Simon Brown

* Simon holds ungeared positions.

Host: Simon Brown

Date: 1 February 2024

Spot uranium price[/caption]

Spot uranium price[/caption]