A Forgotten Gold Porphyry System in Kalgoorlie - Riversgold Limited.

Coffee with Samso Episode 184 is with Julian Ford, CEO of Riversgold Limited (ASX: RGL) updating us on Riversgold's exploration activities since the last conversation in March 2023.

In our previous conversation, we discussed Riversgold Limited as a lithium explorer that I found interesting. One of the reasons I liked them is because they were among the few companies actively engaged in genuine mineral exploration for lithium. It's important for people to understand that the recent discoveries in the lithium sector have largely come from reevaluating previous exploration efforts. Companies have revisited their drill cores and discovered that the historical drilling had indeed encountered pegmatites.

Samso is not begruding of the success of these companies, such as the Mount Holland Lithium project, which is now privately owned and operated by Covalent Lithium. Riversgold, on the other hand, continues its exploration activities in search of valuable lithium-bearing pegmatite.

What I find interesting about Riversgold is their Northern Zone project. When I was researching this topic, I initially found their release titled Farm-in to Significant Porphyry Hosted Gold Project a bit confusing because the project had yielded promising results.

The company is proceeding cautiously to ensure the reliability of these results, which I believe demonstrates prudent management. Julian, in particular, discusses the project and takes a measured view of its potential.

What does Porphyry mean?

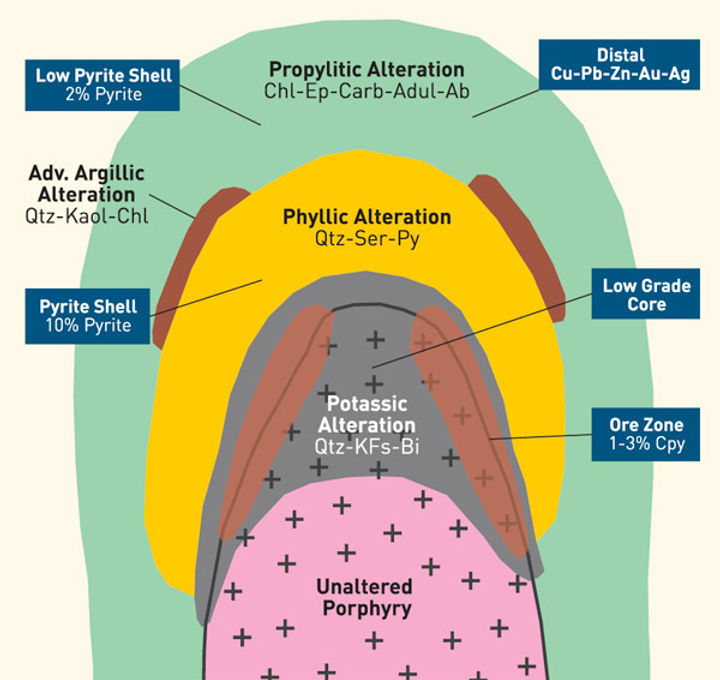

The major products from porphyry copper deposits are copper and molybdenum or copper and gold. The term porphyry copper now includes engineering as well as geological considerations; It refers to large, relatively low-grade, epigenetic, intrusion-related deposits that can be mined using mass mining techniques.

Geologically, the deposits occur close to or in granitic intrusive rocks that are porphyritic in texture.

There are usually several episodes of intrusive activity, so expect swarms of dykes and intrusive breccias. The country rocks can be any kind of rock, and often there are wide zones of closely fractured and altered rock surrounding the intrusions.

As is described following, this country rock alteration is distinctive and changes as you approach mineralization. Where sulphide mineralization occurs, surface weathering often produces rusty-stained bleached zones from which the metals have been leached; if conditions are right, these may redeposit near the water table to form an enriched zone of secondary mineralization.

What is the significance of a Porphyry deposit?

Based on my experience, it is quite rare to find a fertile porphyry that contains only gold. Most porphyry deposits are typically associated with copper. However, Julian informs us that their system at the Northern Zone is devoid of any other metals and is solely a gold system. When we examine the historical drilling results, we can observe significant depth of mineralization, and the grades fall within the range of atypical mineralised porphyry gold system.

Julian has mentioned that they are currently awaiting the results from their recent drilling program. These results will help confirm the assay content and determine if there is any false enrichment present (see below).

It will be fascinating to see the assay numbers and gain a better understanding of the potential of this project. The core samples from the drilling program appear to be in excellent condition, which further adds to the anticipation of the assay results.

Listen to Julian Ford here:

Chapters:

00:00 Start

00:20 Introduction

01:03 Updates from Riversgold

02:57 The Gold Porphyry story

11:22 Metallurgical Cyanide Bottle Roll Test Results

13:37 How did the Northern Zone Project fly under the radar for so long?

19:34 Mt Weld Project

20:54 How should shareholders look at Riversgold?

23:04 Newsflow

23:50 Is the Porphyry story the main focus of Riversgold?

25:26 Why Riversgold?

26:03 Conclusion

Samso's Conclusion

The Riversgold story is an evolving narrative, and I appreciate the adventurous spirit of their projects. Julian impresses me as a composed and strategic individual who possesses a deep understanding of his work. When examining the Northern Zone project, the drilling results are remarkable and align with the expectations for a sizable deposit with low-grade bulk tonnage.

According to the Visual Capitalist, porphyry deposits are very large, polymetallic systems that typically contain copper along with other important metals. Much of today’s mineral production depends on porphyries: 60% of copper, 95% of molybdenum, and 20% of gold comes from this deposit type.

The Bingham Canyon Mine, located in Utah and owned by Rio Tinto and in production since 1906, annually produces approximately:

- 300,000 tons of copper

- 400,000 oz of gold

- 4,000,000 oz of silver

- 30,000,000 lbs of molybdenum

The value of the resources extracted to date from the Bingham Canyon Mine is greater than the Comstock Lode, Klondike, and California gold rush mining regions combined.

So as you can see above, the magnitude of finding a deposit of this nature in a Tier-1 jurisdiction like Western Australia is going to make Riversgold appreciate in market capitalisation.