Chimeric Antigen Receptor (CAR) T-cell therapy is an example of a rapidly emerging immunotherapy approach called adoptive cell transfer (ACT) where patients’ own immune cells are collected and used to treat their cancer.

This newsletter details coverage and billing instructions when the products are used on an outpatient basis and has been updated to reflect HCPCS codes current as of April 1, 2022.

The Center for Biologics Evaluation and Research (CBER) of the Food and Drug Administration (FDA) regulates cellular therapy products, human gene therapy products, and certain devices related to cell and gene therapy. The FDA provides a list of approved cellular and gene therapies including six that are Car T-cell therapies:

Coverage

CMS finalized a National Coverage Determination (NCD 110.24) on Car T-cell therapies on 8/7/2019. The NCD detailed that for Medicare Fee-For-Service and Medicare Advantage, Medicare covers the autologous treatment for cancer with T-cells expressing at least one chimeric antigen receptor (CAR) when:

-

Administered at healthcare facilities enrolled in the FDA risk evaluation and mitigation strategies (REMS)

-

Used for a medically accepted indication, i.e. for either an FDA-approved indication as detailed in the FDA-approved label for the product, or for other uses when the product has been FDA-approved and the use is supported in one or more CMS-approved compendia

When the above requirements are not met, the CAR T-cell therapy is non-covered.

In addition, the routine costs in clinical trials that use CAR T-cell therapy as an investigational agent are covered when they meet the requirements listed in NCD 310.1.

Billing and Reimbursement

HCPCS/CPT codes

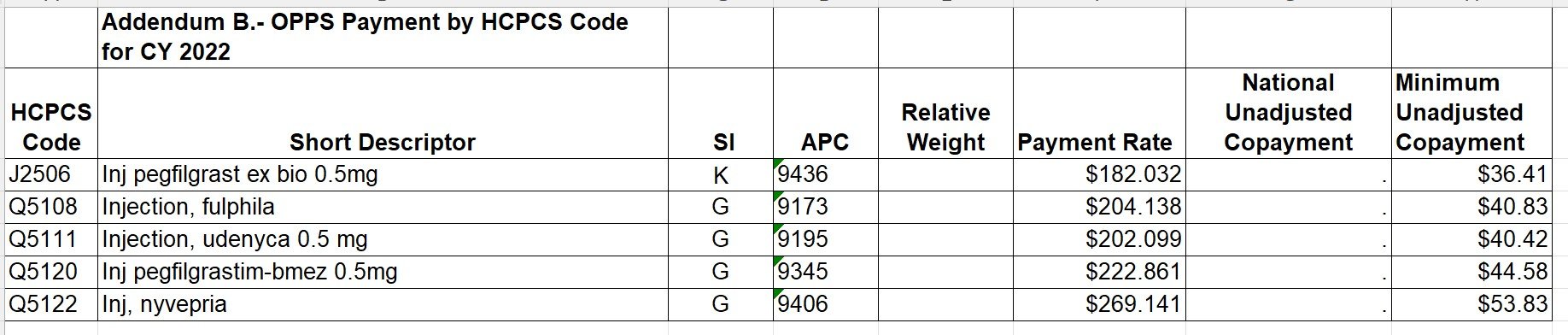

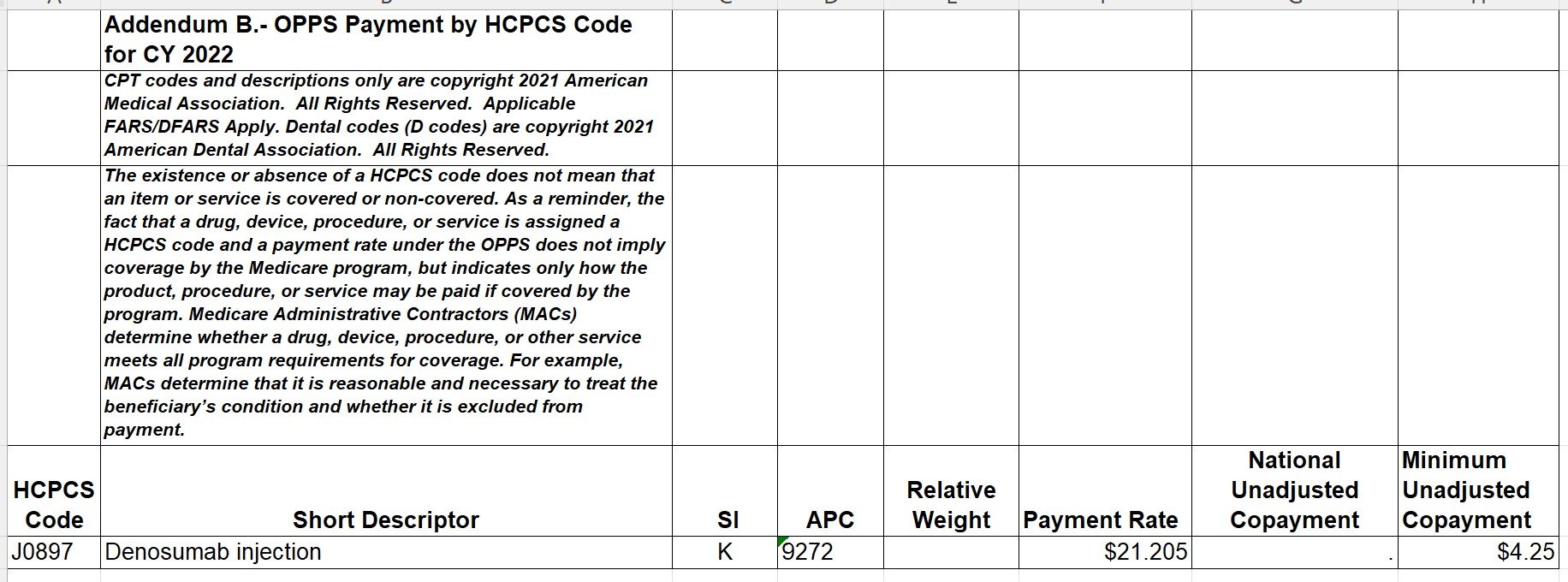

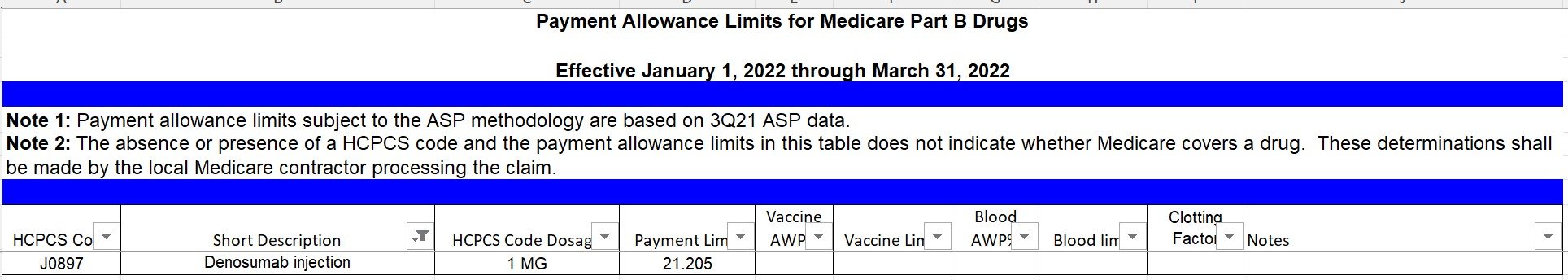

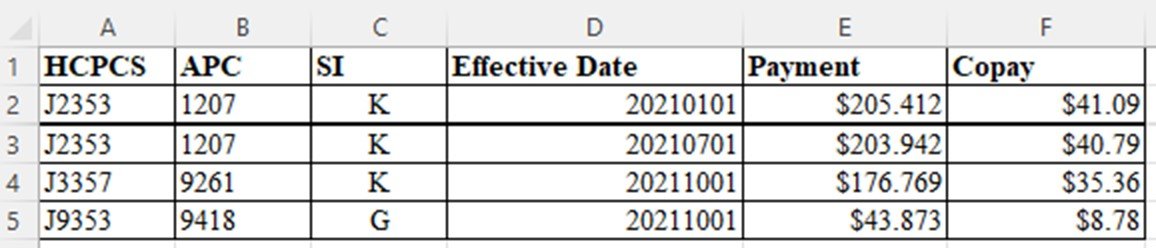

Billing for CAR T-cell therapy on outpatients includes HCPCS codes for the therapies as well as the administration. All CAR T-cell products should be billed with revenue code 891.

Kymriah (tisagenlecleucel) is reported with HCPCS code Q2042- Tisagenlecleucel, up to 600 million car-positive viable T cells, including leukapheresis and dose preparation procedures, per therapeutic dose.

Yescarta (axicabtagene ciloleucel) is reported with HCPCS code Q2041- Axicabtagene Ciloleucel, up to 200 Million Autologous Anti-CD19 CAR T Cells, including leukapheresis and dose preparation procedures, per infusion.

Tecartus- (brexucabtagene autoleucel) is reported with HCPCS code Q2053- Brexucabtagene autoleucel, up to 200 million autologous anti-cd19 car positive viable t cells, includimg leukapheresis and dose preparation procedures, per therapeutic dose.

Breyanzi- (lisocabtagene maraleucel) is reported with HCPCS code Q2054- Lisocabtagene maraleucel, up to 110 million autologous anti-cd19 car-positive viable t cells, including leukapheresis and dose preparation procedures, per therapeutic dose.

Abecma (idecabtagene vicleucel) is reported with HCPCS code Q2055- Idecabtagene vicleucel, up to 460 million autologous b-cell maturation antigen (bcma) directed car-positive t cells, including leukapheresis and dose preparation procedures, per therapeutic dose.

Carvykti (ciltacabtagene autoleucel) (received FDA approval on 2/28/2022, but CMS has not yet assigned a HCPCS code and we recommend that this product be reported with C9399- Unclassified drugs or biologicals. This HCPCS code is used to report newly approved products prior to HCPCS specific code assignment.

The administration of any CAR T-cell therapy should be reported with CPT code 0540T- Chimeric antigen receptor T-cell (CAR-T) therapy; CAR-T cell administration, autologous. This CPT code should be reported with revenue code 874 – Infusion of Modified Cells w/CPT 0540T.

Some payers also require that the claim include a new value code 86 with the invoice/acquisition cost when revenue code 891 is present on an outpatient claim.

CMS provides instructions that providers may include all costs and charges and report them under revenue code 891, or they may separately report cell collection, storage and other preparatory activities. However, CMS does not reimburse these codes separately and they are reported for information only. Detailed examples on these two options for CAR T-cell billing for outpatients is available at CMS Transmittal #10454- (November 13, 2020).

Revenue Codes

CMS has also provided instructions for specific revenue codes to report all services associated with CAR T-cell therapy for inpatients and outpatients. The following Revenue Codes are used:

0871 – Cell Collection w/Current Procedural Technology (CPT) code 0537T

0872 – Specialized Biologic Processing and Storage – Prior to Transport w/CPT 0538T

0873 – Storage and Processing after Receipt of Cells from Manufacturer w/CPT 0539T

0874 – Infusion of Modified Cells w/CPT 0540T

0891 – Special Processed Drugs – FDA Approved Cell Therapy

SHOUT-OUTS!

1. Pharmacy and Revenue Integrity should determine if CAR T-cell therapy will be provided and ensure that appropriate chargemaster entries for the products are established with product specific HCPCS codes and the unique revenue code, 891.

2. Pharmacy, Managed Care and Revenue Integrity should determine if any payers require the invoice cost to be added to claim with value code 86 and establish a process to ensure that the invoice cost is correctly added to the claim.

3. Revenue Integrity and HIM Coders should receive instructions as to which products will be utilized and the medical record location where the administration will be recorded.

4. Pharmacy should ensure that if the product is administered under a clinical trial, or received at no cost from the manufacturer, that it is clearly indicated in the medical record to ensure proper billing and coding.

Our goal is simple; we’re taking complex information and making it practical.

Until our next edition, this is Maxie Friemel and Agatha Nolen providing you with tips for increasing your Pharmacy Revenue.