OD6 Metals Limited (ASX:OD6): The Path To Production - 2024

As we close off 2023, what a better way to end with Coffee with Samso Episode 193 is with Brett Hazelden, Managing Director and CEO of OD6 Metals Limited (ASX: OD6).

The Rare Earth story is now reaching a stage where it is now all about the chemistry. Most followers of the sector are now assuming and accepting that companies will report minerals resources that will be large enough to sustain any operations.

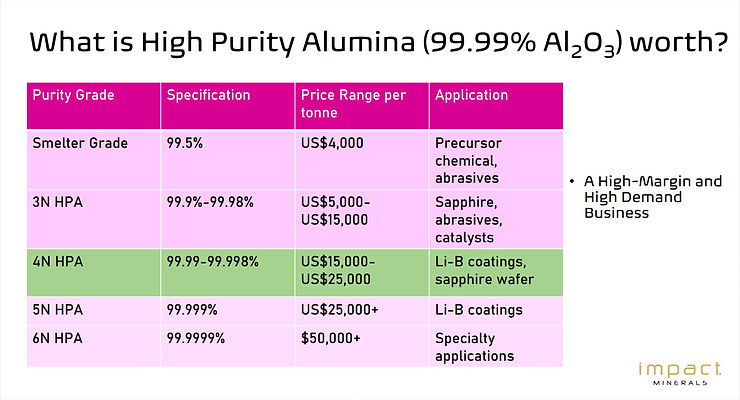

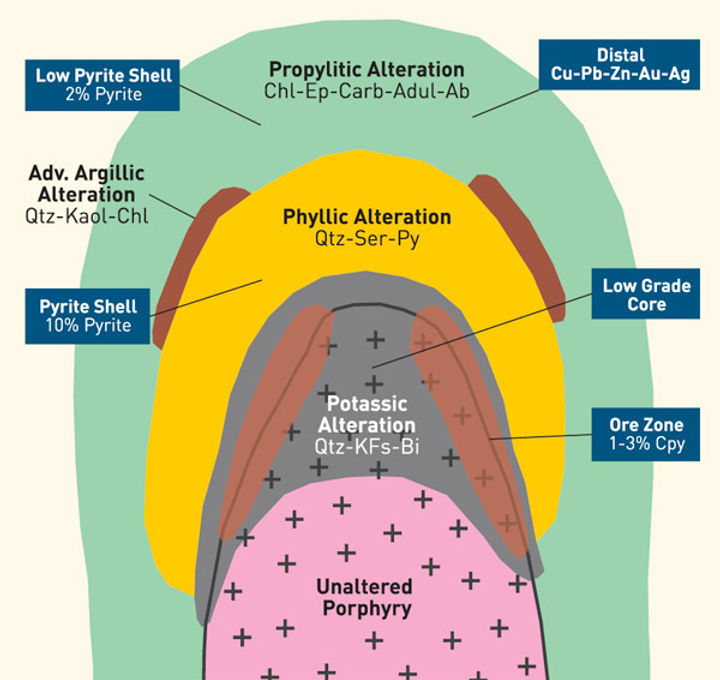

What is unknown is the cost of the chemistry that will bring in the revenue and profits at the end of the exercise. I think in this episode of Coffee with Samso, Brett Hazelden makes a very compelling case for the OD6 Metals story. There is a lot of confusion in the market in terms of what is the end game for these clay rare earth projects.

Brett is a metallurgist and he comes from experience when he talks about the downstream process. For those viewers who are pondering about the Rare Earth sector, this is a must watch episode of Coffee with Samso.

Samso Conclusion

As many of you who have followed the Samso platform, you would have been watching a lot of Rare Earth stories lately. There is no doubt that the rare earth industry is very complicated and confusing which is primarily being fuelled by a cloud of uncertainty on the future. This is something that I had as well but you would have heard me mention this very often, recently, that the trip to the rare earth conference in Canberra has pretty much cleared it up for me.

My optimism that was derived from the conference is not an indication that the sector is going on a bull run. My thoughts are that the reality of a strong future for the demand of rare earths will be very profitable for the companies that stick to their work and are able to sustain their path with funding.

The ability to attract funding over the period is critical. In some ways, you could look at the this time of the market as a reset of the rare earth story, in terms of valuation. This is the time to do your DYOR. For all investors, if the commodity boom is around the corner and the rare earth metals are part of that run, then you would want to do some good research now.

Chapters:

00:00 Start

00:20 Introduction

01:03 2023 recap

03:32 Understanding the chemistry

07:14 Lowering the costs of production

09:45 Discussion about ESG

11:27 What is driving the economics of these clay projects?

15:46 Difference between Australia and South America - grade and processing route?

19:38 Takeaways from the Canberra REECon

26:16 What’s on the cards for 2024?

32:03 Discussion about the rare earth market price

35:14 News flow

36:04 Final thoughts

39:46 Conclusion